Digital Advice

Puts a personalized investment portfolio in the hands of clients not served by an advisor or who have a self service preference.

Why Does Your Firm Need SigFig Digital Advice?

For Clients

Provide quality investment advice to clients of all wealth levels

For Advisors

Create a consistent lead flow for advisors as their clients’ financial needs evolve

For the Firm

Nurture the next generation of investors by providing solutions at each stage of the wealth journey

Self-Service Digital Advice

Puts a personalized investment portfolio in the hands of clients not served by an advisor or who have a self service preference.

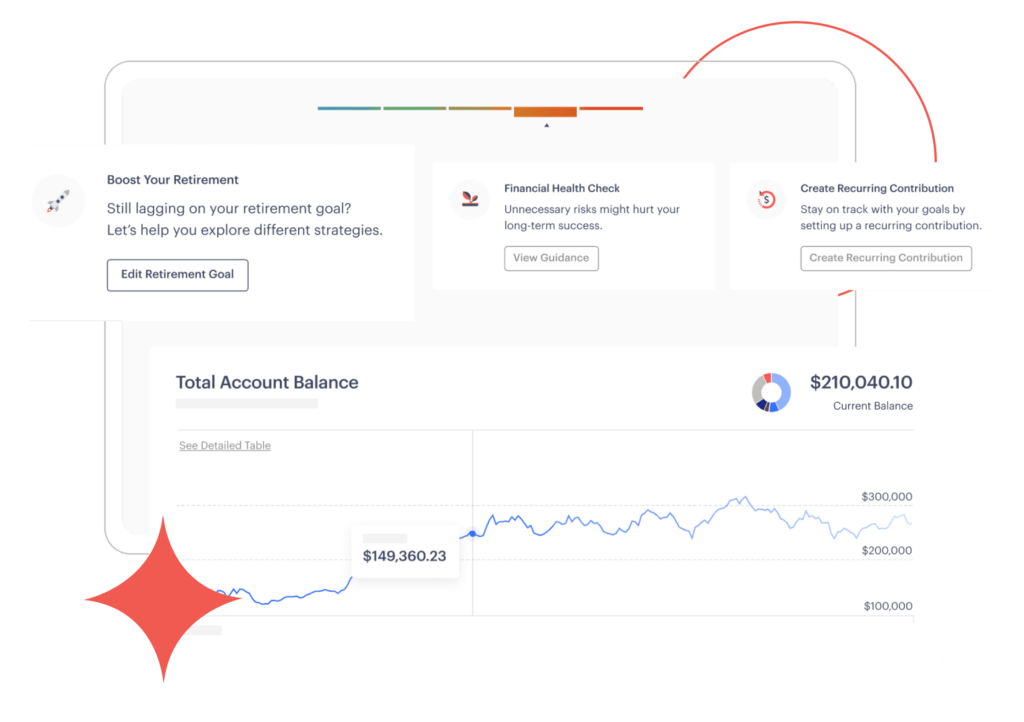

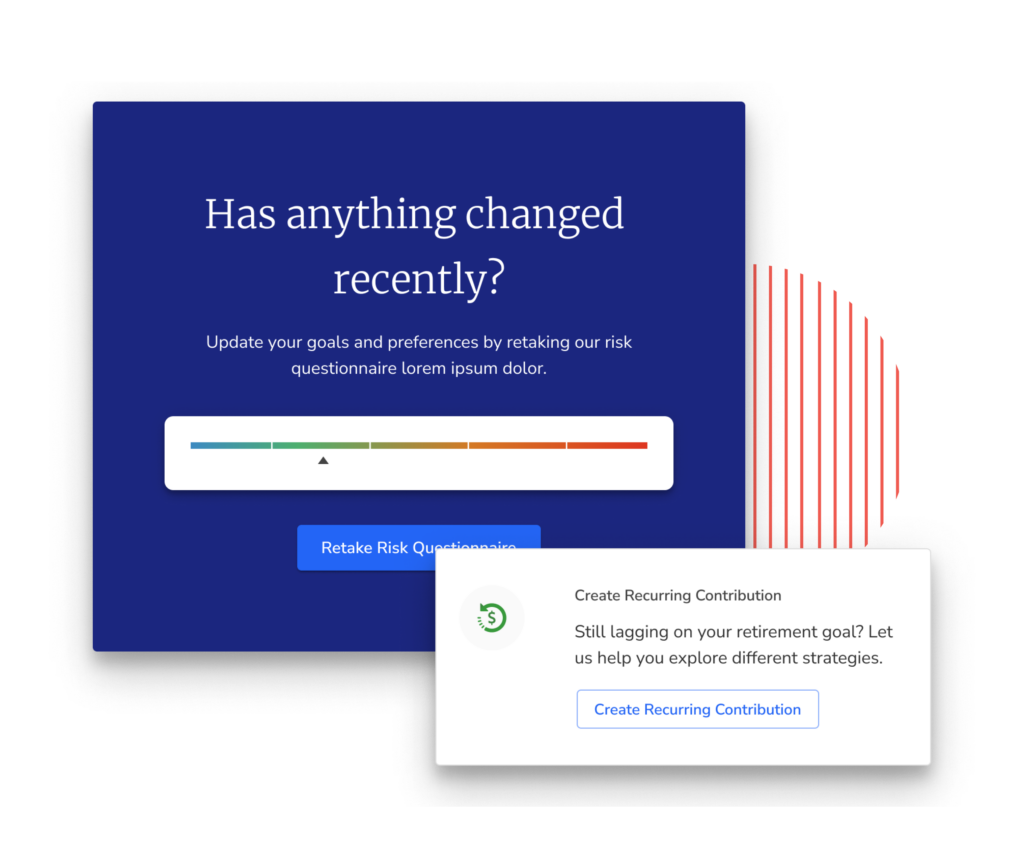

Intuitive Client Experience

Attract new wealth clients with a convenient, intuitive, and low-cost self-directed investing solution.

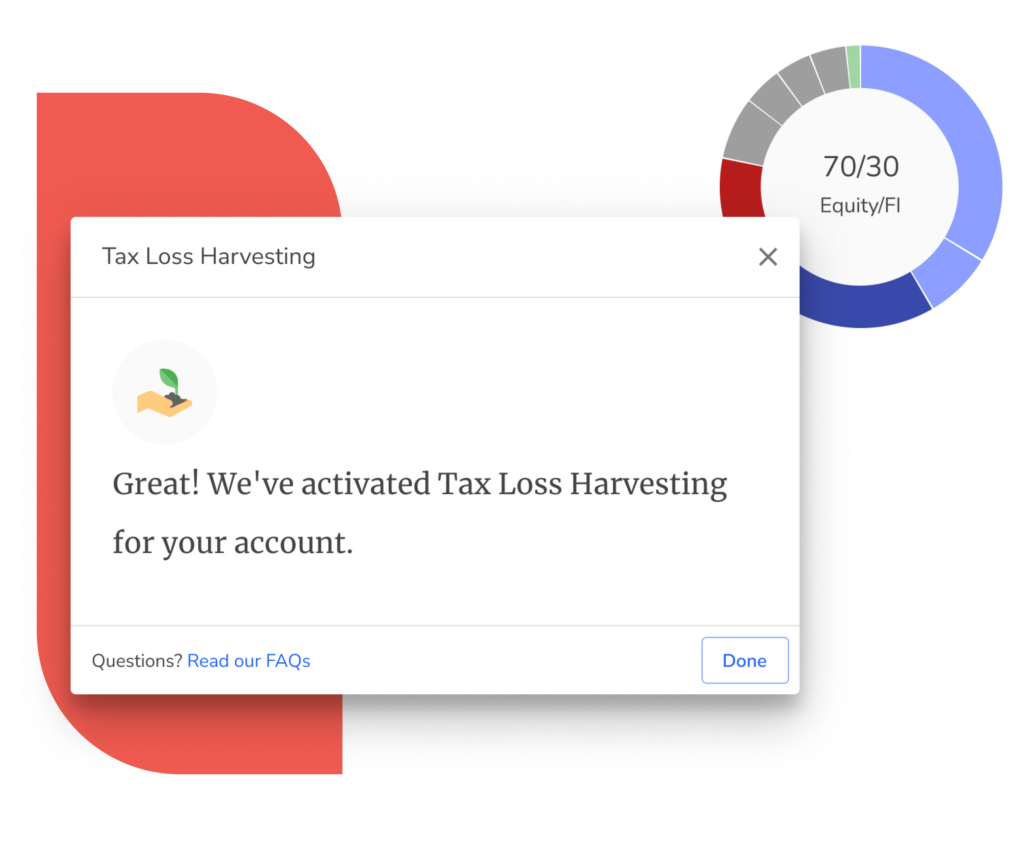

Automated Investment Management

Empower clients to stay on track toward their goals with automated monitoring, rebalancing and tax loss harvesting.

Growth Realized

Thoughtful technology designed to uncover asset gathering opportunities, maximizing funnel conversion and driving client engagement.

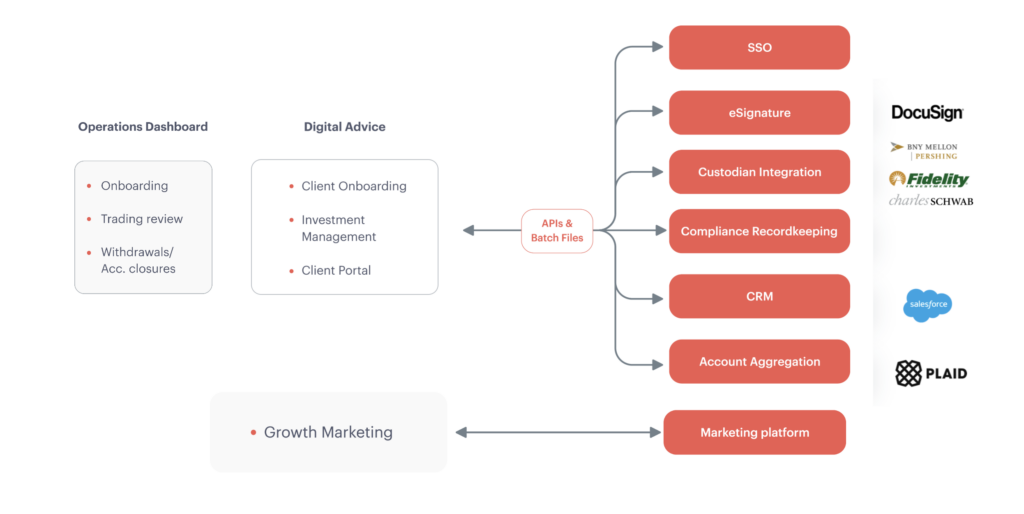

Flexible Integration and Implementation Models

An open architecture concept that integrates into your existing systems and technology stack.

Can you imagine saving 30 days a year to deepen client relationships?

According to Cerulli, advisors spend more than 50% of their time on non-client facing activities like investment research, due diligence and monitoring, trading and rebalancing, and managing day-to-day operations. SigFig can greatly improve efficiency in the majority of these areas by incorporating automation and other tech-enabled functions into your firm’s new client onboarding and servicing processes.

Download our math, Maximizing Reach and Efficiency: How SigFig Can Help Empower Financial Advisors, to learn how you can enable your teams to spend time on what matters most.

Download our math, Maximizing Reach and Efficiency: How SigFig Can Help Empower Financial Advisors, to learn how you can enable your teams to spend time on what matters most.