Overcoming the Digital Divide:

Connecting Advisors and Consumers Using Technology as a Partner

Executive Summary

In 2022, there’s no shortage of financial solutions. The same can be said of financial services providers. However, despite the robust, practically overwhelming availability of services, financial management as a whole remains fragmented and siloed by legacy architecture.

In short, it’s still difficult for many individuals — even wealthy ones with greater access — to effectively and efficiently oversee their finances. Technology paves the way for longevity in the client relationship and long-term viability for today’s growing field of financial institutions.

Key Takeaways

Even in 2022, the financial services industry still faces steep internally driven technology hurdles, such as business silos, legacy architecture, and integration challenges.

Nearly 40% of financial advisors expect to retire in the next decade. Meanwhile, the number of mass affluent and millionaire households isn’t getting any smaller. Firms with a younger cohort of advisors are well positioned to prosper if they can cater to the hybrid needs of the affluent.

50% of high-net-worth and affluent clients think their primary wealth manager should improve their digital capabilities — from personalized offerings and omnichannel access to account consolidation and integrated services.

More and more financial advisors are choosing RIAs. Independence, monetary incentive, and lower technological barriers are the driving forces behind the migration.

The Financial Services Industry is Making Strides, but Investors Want More

If you work in wealth management, you’re well aware of that age-old disclaimer — past results do not guarantee future performance. Yet it’s not exactly stepping out on a limb to argue that the industry‘s future hinges on a critical investment: consolidation and technological expansion.

The consolidation of financial services, such as cash management and financial planning, can provide individuals with more convenience and transparency. Simply put, managing one’s finances is easier when it’s all laid out clearly in one place. And from the perspective of both the financial services provider and the client, the expansion of technological capabilities can unlock more control and data-driven insights, as well as improve the ability to make informed decisions.

The two parties best positioned to connect the dots and deliver a holistic solution are the ones already entrenched in the financial lives of many individuals: retail banks and wealth managers. The former typically welcome individuals into the world of personal finance as people set up bank accounts and budgets for daily transactions. Wealth managers, meanwhile, broaden the scope and assess the long-term big picture of an individual’s financial wants, needs, and goals.

However, both sides face their share of technological hurdles. Retail banking institutions must overcome antiquated legacy architecture that lacks front- and back-end integration, which can make product development a nightmare. As recently as five years ago, 43% of active banking systems ran on COBOL, a programming language that originated in 1959. While that figure has probably improved since then, modernization of a core banking infrastructure is a lengthy, onerous undertaking.

Wealth management firms are likely less restricted than retail banks, but they aren’t necessarily much nimbler — the financial services industry as a whole tends to be a laggard when it comes to tech adoption. So it’s no surprise that firms are still working out the kinks, even in 2022. Although adoption has become commonplace (the average firm uses five different software vendors), integration is another story. One survey found that the lack of integration between core applications is the biggest pain point for 57% of advisors.

Technology isn’t going anywhere. Quite the opposite — it has been and will remain the catalyst behind the future of financial services because clients expect user-friendly platforms with robust functionality. With that in mind, institutions have a choice: invest strategically in digital capabilities or succumb to disruption and potentially lose market share.

People Are Evolving. The Wealth Management Industry Must Too

Investing is ‘in’

The year 2020 will live in infamy for a host of reasons, but there was at least one positive outcome: the universal prioritization of personal finance, most notably investing. McKinsey cites data showing that as of early 2022, the total number of direct brokerage accounts has ballooned by 40%, or 25 million new accounts, since the beginning of 2020 — and first-time investors have accounted for a significant percentage of these.

The catalysts for this in lux are, for the most part, transitory. It’s reasonable to predict that the big stimulus checks we saw during the pandemic, and the stay-at-home mandates that led to an abundance of free time in that period, are unlikely to recur anytime soon. So in all likelihood, the recent uptick in brokerage accounts should slow. Nevertheless, a horde of new investors — dubbed Generation Investor, or Gen I — is now in the market.

The ascent of the affluent

While this flood of first-time investors snagged headlines in 2020 and 2021, don’t forget about the ascent of the affluent. According to Equifax data, from 2014 to 2020, the number of mass affluent households (those with investable assets of between $100,000 and $1 million, although this definition varies) increased from 28.6 million to 38 million. In the same period, this segment’s share of total household assets grew by 38.5% to $13.3 trillion.

Wealth accumulation didn’t stop there. According to the National Bureau of Economic Research, the number of households with a net worth of at least $1 million rose by 30% from 2013 to 2019. Embedded in that rise is an even more dramatic shift — the number of households with at least $10 million ballooned by 70% in that stretch.

More importantly, the preferences of these high net worth households are changing.

And that figure represents a jump from 24% in 2018. That same three-year period also saw a rise in the percentage of affluent investors who worked exclusively with an advisor to manage their wealth, but by a much smaller percentage (29% to 33%).

Age is just a number

In terms of jockeying for position and seizing market share, it’s easy for financial institutions to set their sights on the generations of the future, such as millennials and Gen Z. These cohorts will eventually progress to a point of predominant financial influence, especially after the “Great Wealth Transfer,” in which Broadridge expects elder generations to bequeath $30 trillion to millennials. But that day may be further away than you think.

The U.S. Census Bureau forecasts that baby boomers will comprise roughly 21% of the expected U.S. population in 2030 — good for more than 73 million people. By then every boomer will be over 65 years of age, and that generation should continue collectively exerting pronounced control over the country’s financial landscape.

Financial institutions will have to balance catering not only to younger generations with strong digital preferences but also to elder generations still likely to desire in-person experiences.

Advisors are on the move

The Hybrid Model: A Holistic Solution to Meeting Affluent Client Needs

The affluent are hardly an ignored cohort, but their proclivities may be overlooked or misunderstood by financial institutions. In particular, many high net worth individuals appear to prefer a seemingly contradictory approach to investing — overseeing self-directed accounts while also working with a traditional advisor, either remotely or in person.

Conventional wisdom would suggest that the need to handle one’s own finances diminishes as wealth increases, but statistics show otherwise. The level of self-guided financial planning actually rises alongside investable assets, according to a survey of affluent households by Javelin Strategy & Research.

In that vein, there’s a strong correlation between clients who frequently engage with their advisors and those who explore off-platform financial planning (68% of respondents), according to Javelin. In other words, investors who meet frequently with their advisors also tend to use third-party financial management tools.

Additionally, 77% of respondents to McKinsey’s Affluent and High Net Worth Consumer Insights Survey indicated they preferred to primarily correspond with their advisors through either a digital medium (website or app) or a remote channel (email, phone, video conference). And 50% of clients under the age of 45 were comfortable with digital-only advice.

In short, there’s a strong case for adopting a hybrid model that prioritizes digital capabilities, and this may be the key to growth and longevity for financial institutions over the next decade and beyond.

The battle of consolidation

On top of professional guidance, more and more affluent investors want the two Cs — convenience and control — and not just from an investing standpoint. The individuals in this high net worth, digitally attuned cohort want to consolidate their finances.

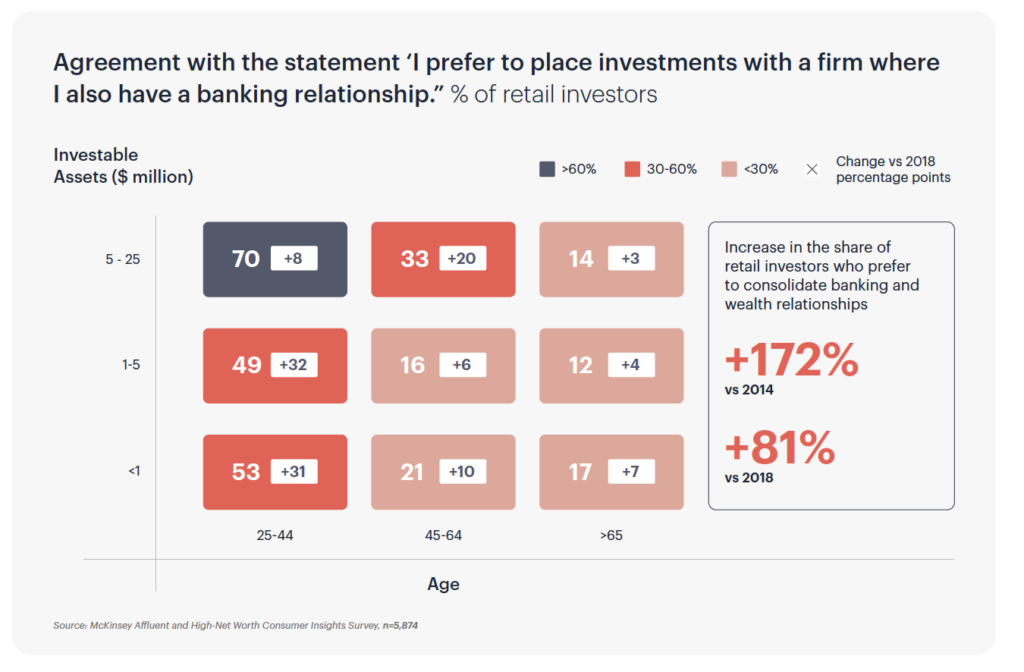

Per McKinsey’s survey, respondents aged 25 to 44 indicated a strong preference for combining their banking and investing relationships, whether they had less than $1 million or as much as $25 million across their accounts. For instance, 70% of respondents with investable assets of $5 million to $25 million wanted to invest with a firm with which they also had a banking relationship. Significant wealth wasn’t the sole determinant, though. Even the majority of those with less than $1 million of investable assets desired a singular financial relationship.

That said, there’s a key discrepancy: the institution of choice for consolidation.

Younger investors would rather consolidate wealth management with their primary bank provider, according to McKinsey, while older investors and those with sizable net worth figures are more likely to do the opposite, merging banking services with their primary wealth-management provider.

In either case, the path to differentiation is personalization, which McKinsey says is the third-highest factor for clients seeking out professional guidance, regardless of age. By making the right technological investments, institutions can o er highly customizable, tax-efficient solutions at scale.

Who’s winning the battle of consolidation?

The fight to offer holistic solutions is already underway. On the wealth management front, many of the largest institutions have sought to appeal to the younger, mass-affluent segment by investing in digital engagement.

For instance, in 2020, Edward Jones announced a $500 million investment into

transforming its digital offerings, including the introduction of new tools and features to enhance client-advisor relationships. These included financial goal progress trackers, account aggregation, cash management, and secure communications through the client portal.

Technology is Here to Stay, but Which Features Should Institutions Target?

Technology and financial services are inextricably linked. But we won’t see

tech-driven solutions like robo-advisory outright replace financial advisors. It’s not a zero-sum game. It’s a complementary relationship. That’s true from the perspective of the end client and of the financial institution.

50% of high net worth and affluent clients think their primary wealth manager should improve their digital capabilities, from personalized offerings and omnichannel access to account consolidation and integrated services. Advisors share this sentiment — 87% of advisors want more digital capabilities, such as tools backed by artificial intelligence that can streamline mundane or complex processes.

“In the end, investor digital migration strengthens, not replaces, the advisor relationship, and elevates the advisory value proposition by facilitating incremental collaboration,” says Greg O’Gara of Javelin Strategy & Research. “Advisor recommendations can be independently validated, and investor questions that arise can otherwise be discussed in a virtuous cycle with the advisor.”

Let’s explore which capabilities financial institutions should prioritize.

Account aggregation and data analytics

The data supports building out account aggregation functionality and data analytics. Investors want a comprehensive view of their finances, and they can more effortlessly grasp the big picture through a unified lens rather than via scattered, multi-platform accounts.

Broadly speaking, account aggregation software has reached a point of mass adoption. According to a Kitces Research survey, more than 60% of respondents had adopted account aggregation software, but collective satisfaction was mediocre (a little over 6.5 on a 10-point scale). This suggests an opportunity for improvement, whether that’s through in-house development or outsourcing with a properly vetted vendor.

Data gathering and onboarding

While it’s reasonable to say AI hasn’t reached its full potential yet, one thing is certain — AI can streamline trivial, time-consuming aspects of wealth management. That’s particularly true in the case of data gathering and onboarding.

Even firms with expansive physical footprints and in-person services can bene it from digital onboarding processes. Firms can reduce points of friction, saving clients the hassle of filling out paperwork while simultaneously negating the need for data entry and client-profile building. Automated features make it far easier to construct a thorough overview of a client’s existing investments, accounts, financial goals, risk tolerance, and so on.

Advisors rated document management and data gathering as important in the Kitces survey (both well above 7 on a 10-point scale), but adoption figures didn’t quite match that enthusiasm — more than 30% of respondents lacked document management software, while about 75% lacked data-gathering software.

Automated insights

Tax and compliance

Tax-optimized solutions can help pinpoint efficient, return-friendly paths forward.

For instance, automated tax-loss harvesting may uncover significant savings, potentially reducing an investor’s liability come tax time.

In terms of adoption, tax and compliance technology are on the lower end, according to Kitces (both under 40%), but these facets of financial management are objectively important (between 8 and 8.5), not just from a regulatory standpoint for an advisor but also in terms of a client’s net returns.

Narrowing the Divide: Technology Paves the Way to Streamlined Financial Services

Financial institutions are making progress in terms of consolidating financial management for their clients and bolstering their client portals with key features. But there’s still work to be done.

Financial institutions are making progress in terms of consolidating financial management for their clients and bolstering their client portals with key features. But there’s still work to be done.

Banking customers are typically satisfied with their provider’s digital offerings when it comes to day-to-day money management. However, longer-term financial planning left much to be desired — according to Javelin data, only 55% were satisfied, driving roughly 4 in every 10 customers to third-party solutions. Wealth-management firms tend to su er the same fate: More than two-thirds of investors needed to use third-party apps to manage their money out of necessity, citing functional constraints and poor user experiences, according to Javelin.

While supply and demand may have an inverse economic relationship, that’s not

necessarily the case with respect to financial technology and financial management. The more options there are at an individual’s disposal, the higher those options can raise the bar. In other words, the abundance of third-party fintech solutions puts inordinate pressure on institutions to meet client demands — if your platform can’t deliver the features people want, they’ll look elsewhere.

Bucking these trends starts with the strategic deployment of state-of-the-art technology. For both wealth managers and bankers, partnering with a fintech provider can help not only navigate the aforementioned legacy tech and integration hurdles but also transform your digital platform to accommodate the hybrid needs of affluent clients.

We can help with that.

With SigFig’s Digital Advice Pro, advisors and bankers can streamline the client experience through features like digital onboarding and automated rebalancing, while also offering risk-aware, tax-efficient solutions at scale. In turn, institutions can continue leaning into their core functions while taking advantage of opportunities to expand client relationships through complementary offerings.